35+ Credit card debt payment calculator

Most other credit cards like Capital One and Chase give you a. 2 If youre having credit issues the 153 credit card.

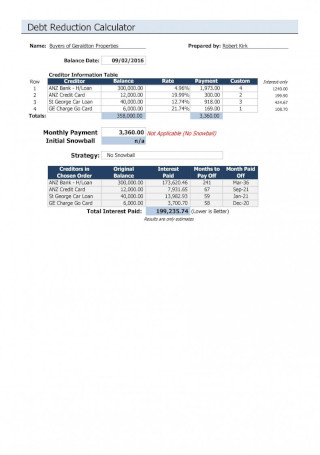

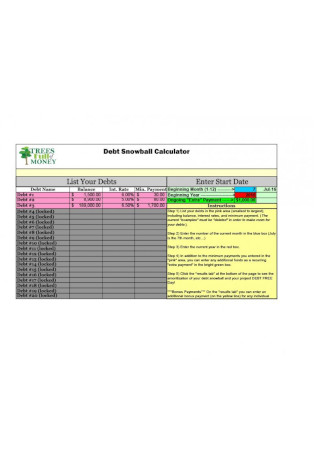

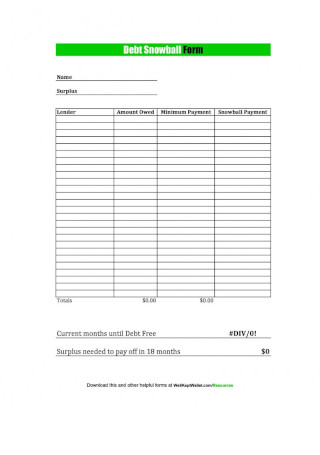

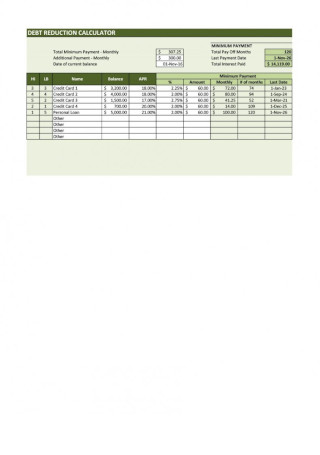

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

By taking the proceeds of a personal loan to pay off credit card debt you can eliminate multiple monthly high-interest card.

. A Helpful Guide to Getting Out of Debt. Your monthly payment and total. Men own 29 more credit card debt than women 7407 vs.

Just one 30-day late payment can hurt your credit scores. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk. The credit card company turns your account over to collections and in 2010 you start getting notices about your debt.

Interest on a credit card like a Visa card is charged at an annual rate which is calculated and charged monthly to your credit card balance. The same applies to your credit card debt. You can review a guide to the statute of limitations on debt in each state to better understand the time line on your debt.

Typically the minimum payment is a percentage of your total current balance plus any interest you owe. Alaska 6910 has by far the highest debt ahead of Colorados 5625 and Connecticut 5617. By comparison the fee for an expedited ACH transfer two business days vs.

That means if you make 36000 a year the car price shouldnt exceed 12600. This is the cost of the home minus the down payment. Heres How Much Car You Can Afford Follow the 35 Rule.

The average cardholder had 5769 in credit card debt in Q1 2022 up from 5611 in Q1 2021. This is because credit card debt. After which the credit card will require payment of interest on top of the principal.

Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. Households find themselves buried in debt. Despite that achievement credit problems are still common.

Residents Florida documentary stamp tax is required by law calculated as 035 for each 100 or portion thereof of the principal loan amount the amount of which is provided in the Final Disclosure. Payment history is the single-most important factor affecting your credit score making up 35 of your FICO Score and 41 of your VantageScore. LaToya Irby is a credit expert who has been covering credit and debt management for The Balance for more than a dozen years.

Some cards may restrict your grace period when you dont pay your statement balance in full so any. Credit card debt totaled 841 billion in Q1 2022 down from 893 billion in Q1 2020 the last quarter before the pandemic but up 71 billion from Q1 2021. By making on-time or early paymentsyour payment history makes up.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. The Discover Card is one of several credit card sources that offer free credit scores. A late payment on a credit card carries the same effect as a late payment on an auto loan or mortgage.

Start by entering the mortgage amount. 1 Approximately 21 of consumers were denied a credit card loan or residence lease last year because their credit score was too low. There is usually a dollar amount for your minimum monthly payment also so it may be expressed as something like 35 or 2 of your balance plus fees whichever is greater.

If the interest on a credit card is 10 pa then interest on a balance of 2000 will be charged monthly on pro rata of that 10 pa. Three increases to 335 and 15. Before you try to make your car payment with your credit card there are some caveats to consider.

Someday Im going to get rid of this credit card debt. Activity is often defined as making a payment or drawing funds from an account. So if you owe 2000 your minimum payment might be 40.

Individuals 75 or older had the most debt 8100 and those under 35 had the least 3700. Americans overall have better credit than ever before. Free credit card calculator to find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame.

The average American credit score hit a record 710 in 2020. Rate ranges for Lending Club and Discover are based on data compiled in July 2021 from company websites. Payment history is the most influential factor in calculating your credit score accounting for roughly 35 of your FICO Score the score used by most lendersAny late payment reported to the credit bureaus will have a swift and significant effect on credit scores and will remain on your credit report for.

Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income. Transferring your current credit card balance to a new card with 0 percent APR may save you more money than taking out a debt consolidation loan. For example if.

The average credit card interest rate is about 20 and that means any debt left after your minimum payment will grow by 20. Discover provides your FICO score the one used by 90 of businesses that do lending. Consumers have started to return to bad habits when it comes to credit card debt.

Keep making your monthly credit card payments as planned. You pay 400 toward the debt in September 2010. According to CNN Money the average indebted household in the United States owes more than 15000 in credit card debtThe average mortgage debt stands at roughly 153000 and the average student loan debt is more than 32000.

The 6-year clock resets which means the collection agency has until October 2016 to file a lawsuit against you to collect the rest of the debt. Simply complete the fields in the form below and click Calculate button. We all have heard someone including ourselves say.

Following a record-setting reduction in 2020 consumers added a total of 862 billion in new credit card debt to their tab during 2021 capped off by a 731 billion increase during the fourth quarter alone. For example the last time you used a credit card to make a purchase or made a payment on the balance of the card. Managing Your Credit Card Debt.

Credit card balance transfer. Debt Consolidation Loans for Bad Credit Debt Consolidation Calculator Best Balance Transfer. Some cards can charge a fee of 3 or 4 of the total amount transferred.

Sales Commission And Costing Calculators Templates Excel Templates Statement Template Excel Templates Mission Statement Template

Grocery Budget Calculator Is Your Grocery Budget Out Of Control

Quicken Premier Software For Windows Download Quicken Today

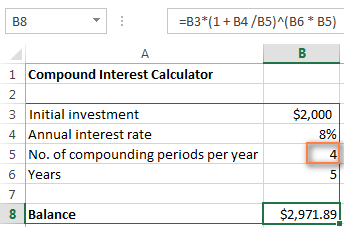

Compound Interest Formula And Calculator For Excel

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

The Week On Wall Street Inflation Feeds The Bear Nysearca Spy Seeking Alpha

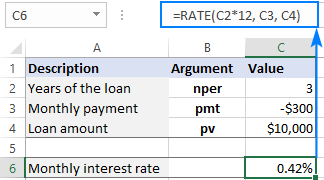

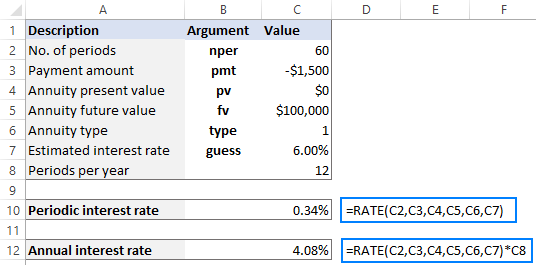

Using Rate Function In Excel To Calculate Interest Rate

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Best Personal Loans In Cleveland Oh Top Lenders Of 2022 Moneygeek Com

Finance Stickers Budget Planning Stickers Bill Check Sticker Etsy Planning Stickers Planner Stickers Free Printable Planner Stickers

Using Rate Function In Excel To Calculate Interest Rate

Deals On Twitter Planejamento Financeiro Objetivos Financeiros Lista De Convidados De Casamento

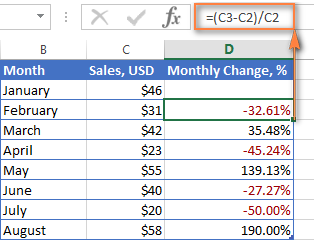

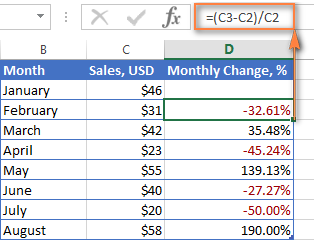

How To Calculate Percentage In Excel Percent Formula Examples